Professional Tips on Successful Financial Debt Debt Consolidation: More Discussion Posted Here

Professional Tips on Successful Financial Debt Debt Consolidation: More Discussion Posted Here

Blog Article

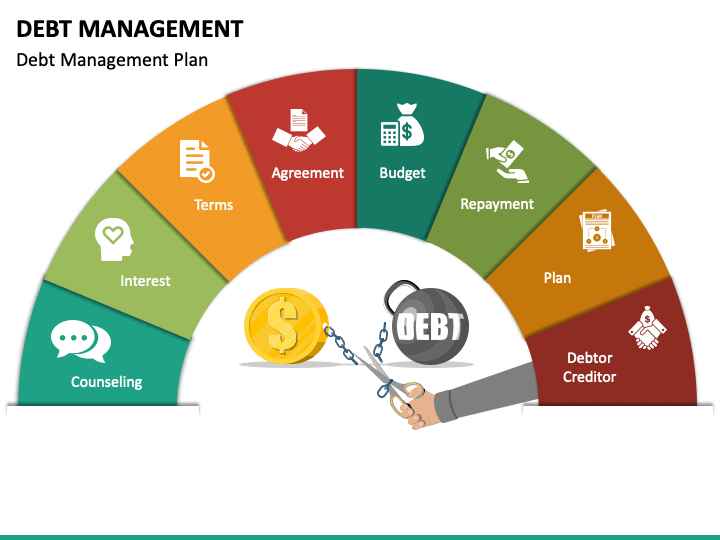

The Comprehensive Overview to Creating and Performing an Effective Financial Debt Management Plan for Lasting Financial Obligation Alleviation

Evaluating Your Financial Obligation Circumstance

When starting the trip to develop an effective financial debt administration strategy, it is important to begin by extensively analyzing your existing debt circumstance. More Discussion Posted Here. This first action is critical as it provides a clear understanding of the degree of your financial debts, the rate of interest prices attached to each debt, and the minimum month-to-month payments needed. By assembling a comprehensive list of all your financial obligations, including charge card, loans, and any type of various other outstanding balances, you can obtain insight right into the total quantity owed and prioritize which debts to tackle first

When assessing your financial debt situation, it is very important to assess your revenue and costs to figure out just how much you can reasonably allocate towards financial debt repayment monthly. This analysis will help you create a budget that ensures you can meet your debt obligations while still covering essential living costs. In addition, by recognizing any type of unnecessary expenses that can be minimized or removed, you can maximize more funds to put in the direction of repaying your debts successfully.

Establishing a Budget Plan

To successfully handle your finances and attain your financial debt payment goals, it is vital to create a thorough budget plan. Designate a portion of your earnings in the direction of savings and an emergency situation fund to prevent accumulating more financial obligation in situation of unforeseen costs. Consistently review and change your budget as required to stay on track towards accomplishing financial security and successfully handling your debt.

Discussing With Creditors

Engaging in conversations with lenders is an essential step in proactively attending to and fixing impressive financial debt responsibilities. Start by collecting all relevant information regarding your financial obligations, including account details, superior equilibriums, and rate of interest rates.

Throughout arrangements, be truthful regarding your financial challenges and interact honestly regarding your readiness to settle the financial debt. Creditors are often going to collaborate with people who show an authentic initiative to fix their commitments. You can review possible options such as restructuring the repayment plan, discussing a reduced passion price, or perhaps clearing up the financial obligation for a reduced quantity.

Keep in mind to document all article communication with lenders, consisting of contracts gotten to, layaway plan established, or any kind of adjustments to the regards to the financial debt. By taking part in constructive discussions and reaching mutually valuable contracts, you can pave the means in the direction of lasting financial debt relief and economic stability.

.webp)

Applying Debt Repayment Approaches

A critical facet of managing financial obligation efficiently is the execution of well-balanced repayment techniques. When implementing financial obligation repayment approaches, it is vital to begin by focusing on financial debts based on factors such as rates of interest, superior equilibriums, and creditor terms. One common technique is the financial debt snowball approach, where you concentrate on settling the tiniest debts first while making minimal settlements on bigger financial debts - More Discussion Posted Here. This approach can supply a sense of success as financial debts are settled, inspiring you to proceed the procedure.

One more strategy is the financial debt avalanche technique, which entails prioritizing financial obligations with the highest rate of interest rates to minimize the general rate of interest paid over time. Checking your progress regularly and adjusting your methods as required will certainly make sure that you are efficiently managing your financial debt and working in the direction of economic liberty.

Monitoring and Readjusting Your Plan

Frequently evaluating and fine-tuning your debt administration plan is important for keeping financial stability and achieving your lasting goals. Monitoring your strategy entails tracking your progress, evaluating your budget plan frequently, and staying upgraded on your outstanding debts. It is vital to monitor your plan to make certain that you get on track to satisfy your repayment objectives and make any needed modifications as your monetary circumstance changes.

One means to check your debt monitoring strategy is by routinely assessing your spending plan and expenditures to determine locations where you can reduce look at here expenses and allot more funds in the direction of financial obligation settlement. By tracking your investing practices and reassessing your budget plan periodically, you can make enlightened decisions on exactly how to optimize your financial obligation payment strategy.

In addition, checking your plan permits you to remain inspired and concentrated on your financial objectives. Commemorate small victories in the process, such as repaying a credit scores card or decreasing a significant section of your financial obligation. These landmarks can keep you motivated and committed to sticking to your debt administration plan for sustainable debt alleviation.

Conclusion

To conclude, creating and executing a reliable financial debt monitoring strategy requires an extensive assessment of your debt scenario, the growth of a budget strategy, arrangement with financial institutions, execution of debt payment methods, and continuous tracking and modification. By adhering to these steps, individuals can accomplish lasting debt relief and take control of their monetary future.

With mindful planning and tactical decision-making, crafting a thorough financial debt monitoring plan is not only possible however additionally crucial for long-lasting financial debt alleviation.When beginning on the trip to develop an efficient debt management strategy, it is important to begin More Discussion Posted Here by completely examining your present financial debt circumstance. When carrying out debt repayment techniques, it is vital to start by focusing on debts based on variables such as rate of interest prices, superior equilibriums, and creditor terms. One typical strategy is the financial debt snowball technique, where you concentrate on paying off the smallest financial debts initially while making minimal settlements on larger debts. These milestones can keep you encouraged and committed to sticking to your financial obligation monitoring strategy for lasting financial debt alleviation.

Report this page